Gaining Trust With Buyer Segments in the Home Buying Journey

Our attitudinal research study found four unique segments of home buyers: Builder Preferrers, Researchers, Worriers and Online Preferrers — to learn more about them, check out our first blog post. Depending on their attitudes, different home buyers represent different trust potentials. Our research demonstrates that home buyers who need more research to feel confident and those with a lot of worries about the home buying journey will take longer to build trust with home builders.

Connecting with these two segments takes a long-term strategy and patience. However, there are two segments of home buyers that builders can focus on in the near term to capture their attention. In today’s post, we’re going to dive deeper into these segments and how to build trust with each of them.

You Might Also Like

How to Attract New Home Buyers: Insights for Home Builders

Home Buyer Priorities: Why Durable New Homes Matter

Prioritizing Cost: How Home Builders Can Assist Home Buyers

What Home Buyers Want in 2023

How Buyers Approach Online Home Buying

Which Attitudinal Segments to Target

Out of the four attitudinal segments, we recommend targeting Builder Preferrers and Online Preferrers first as the barriers to entry for their attention and investment are much lower than other segments.

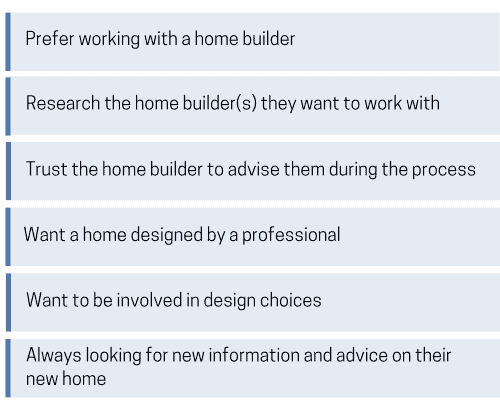

Builder Preferrers

This segment is unlikely to engage in the home buying journey if they don’t have a home builder to directly work with. They see a home builder’s expertise as essential to getting what they want in a home: the best of the best. Trust comes easily to them as they actively seek a builder’s input, such as interior design choices, although they want to actively participate in the process themselves.

These home buyers are significantly more likely to say a home builder is an important part of the home buying process (that means you’re already part of their plan before they put it into action). When looking at potential homes, they’re more likely to have visited models to get a feel for the home’s potential.

Builders can target Builder Preferrers by ensuring their reputation and home buying process are well documented. Builders that don’t have reviews within Google Business profiles, Facebook, New Home Source and more stand to lose out to builders that have reviews in these sources. Once these potential new home buyers visit a builder’s website, it’s smart to have written and video testimonials placed throughout the site to reinforce a good, solid reputation.

Once the Builder Preferrer has chosen a builder, it’s time to engage them in an immersive process that includes on-site visits with the sales and design teams where buyers can explore the options and choices available to them at each point in the home buying journey. Working with these customers will require a concierge approach that will maximize the builder’s opportunity for adding options and increasing the value of the new home sale. If the builder’s process fails to engage these leads, buyers will find a different builder who will allow them to participate in the process from beginning to end.

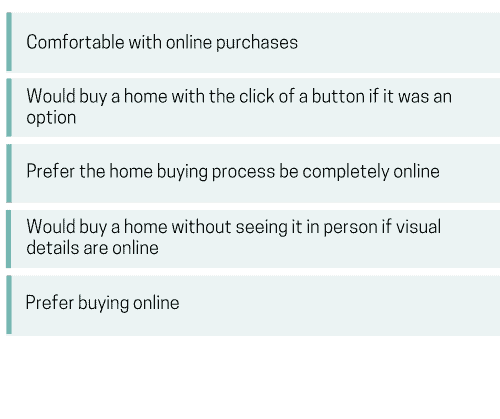

Online Preferrers

This attitudinal segment is ready and willing to purchase a home with the click of a button. They don’t need to see a home in person as long as they can see detailed information online before purchasing. They’re significantly more likely than other segments to want an online component of the home buying journey the next time they buy a home. These home buyers are the most likely of any segment to think being completely online would improve the home buying journey.

Other key things to note about this segment: These buyers are younger and have higher annual household incomes. They’re looking for their home buying journey to be as easy as possible. Compared to other segments, they have fewer priorities during the home buying process, including cost. They are also less likely to worry about the home builder’s reputation.

Although it may seem counterintuitive, you’re less likely to reach these home buyers on home buying websites like Zillow. In fact, you’re more likely to connect with them through social media platforms, especially Twitter and Instagram.

Online Preferrers are the most likely group to buy a home sight unseen. As a result, they need video tours, Matterport tours and lots of imagery to see the home to make a decision to buy model A versus model B. Builders that combine engaging content with a consultative Online Sales Counselor (OSC) will have better success converting these leads into home buyers. Builders that only use their OSC to schedule an appointment will lose opportunities to convert them.

Building Trust, Increasing Your Leads

Out of the four attitudinal segments, Researchers and Worriers take more time to build trust with builders — but for entirely different reasons.

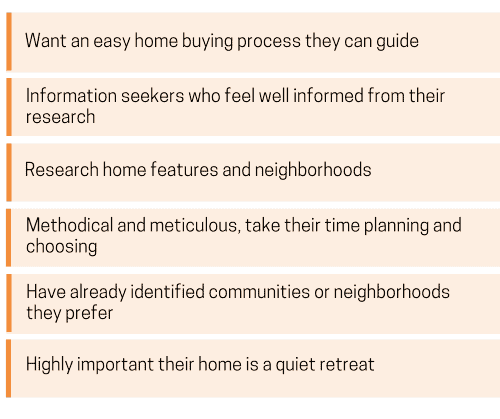

Researchers

Like Online Preferrers, Researchers want the online home buying journey to be easy, but they need a lot of information to feel good about their decision. They are especially likely to use home buying websites such as Zillow, Trulia, or Realtor.com, instead of trusting a home builder, because they feel well-informed due to their research efforts. They identify neighborhoods or communities they want to live in ahead of time and want their house to be a sanctuary where they can rest and relax.

These home buyers are more likely to anticipate spending under $250K on a new house. They’re also significantly more likely to opt out of new builds and buy a previously occupied house. While they’re not opposed to online elements of the home buying journey, they’re the most likely to be able to ask questions and engage with another human when buying a home.

These customers are more likely to buy a spec home because they will be actively comparing pricing and value relative to the information they find on resale homes sites like Zillow or Realtor.com. Builders chasing this group of buyers must have transparent pricing and easily accessible information on the community, including schools, retail amenities, etc. This group of customers will also want easily accessible information about the home, the purchase process, financing and warranty — and find it all documented online.

Creating a brochure with answers to key questions will go a long way for this group before talking to a knowledgeable OSC or on-site sales person who can dive deeper into their concerns. Builders that don’t provide this information will likely lose the sale to a resale home in the same price point.

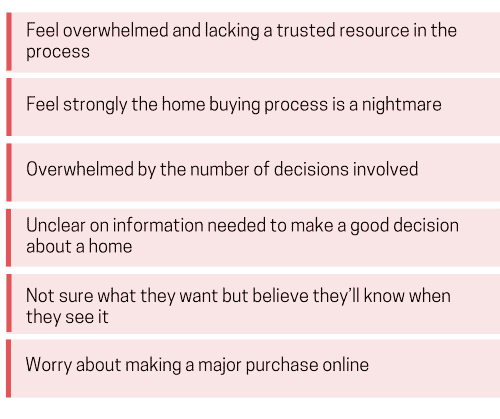

Worriers

This group experiences a lot of stress and anxiety during the home buying journey because they feel they don’t have someone on their side they can trust. These home buyers are paralyzed; they don’t know what information they need to make a good decision and cannot articulate what they want in a home. It’s no surprise that the idea of buying a home online worries them.

In regard to demographics, these home buyers are younger, which partly accounts for their confidence issues, and need a lot of help to feel confident. Like Researchers, they’re more likely to say they plan to spend under $250K on their next home.

Builders can establish trust with this group by providing detailed answers to questions in a brochure and by providing a concierge service with an OSC or on-site sales team who can hand-hold this lead through the entire home buying journey. The builder should assume these customers know absolutely nothing about buying a new home and will need to provide a simple and easy process that will reassure these leads.

However, builders need to make sure they are willing to invest the time and energy needed to educate and convert these leads into sales because they can be a challenge throughout the process. If a builder is able to successfully nurture a worrier to a sale, all of the content and the process to guide them will be invaluable for each of the other three attitudinal segments as well.

To learn more about each segment’s behaviors and the opportunities they present, check out our entire executive summary. And to explore the data yourself, check it out here.

Check out the research!